Module 1: Accounting Basics

Table of Contents

Let's have fun - we will start our own Business and act as the Bookkeepers/Accountants for the new venture!

Starting our adventure

The Accounting Equation is the fundamental formula in accounting, representing the relationship between a company’s assets, liabilities, and equity. It is the foundation for double-entry bookkeeping. The equation is expressed as:

Assets = Liabilities + Equity

Here’s what each term means:

Assets: These are resources owned by the company that are expected to bring future economic benefits. They include cash, inventory, property, equipment, and accounts receivable.

Liabilities: These are obligations or debts that the company owes to outside parties, such as loans, accounts payable, or bonds payable. Liabilities represent claims against the company’s assets.

Equity: This represents the owner’s claim on the company after all liabilities have been paid off. It’s often referred to as “owner’s equity” or “shareholders’ equity” for corporations. It includes common stock, retained earnings, and additional paid-in capital.

Balance: The equation ensures that the company’s financial statements are balanced. If a company buys an asset (e.g., equipment), it must either borrow money (liabilities) or use its own funds (equity) to finance the purchase.

Double-entry System: This equation is the basis for double-entry bookkeeping, meaning every transaction affects at least two accounts, keeping the equation balanced. For example, if a company takes out a loan (increasing liabilities), its assets (cash) also increase.

- If a company has R10,000 in assets and R4,000 in liabilities, its equity would be R6,000 (10,000 = 4,000 + 6,000).

The Double-Entry Concept, Debits and Credits

The Double Entry concept is the fundamental principle of bookkeeping and accounting, where every financial transaction affects at least two accounts.

Every transaction is therefore recorded in two places. To illustrate, here are a few transactions and the two accounts that will be affected:

The Double Entry Concept

| Transaction | Account Debited | Account Credited |

|---|---|---|

| Company Purchased a vehicle using Cash in Bank | Fixed Assets - Motor Vehicles | Company Bank Account |

| Company Purchased a vehicle using Credit Installment Loan | Fixed Assets - Motor Vehicles | Long Term Laibility - Loan |

| Company Purchased Inventory using Cash in Bank | Inventory | Company Bank Account |

| Company Purchased Inventory on Credit from Supplier | Inventory | Accounts Payable [Liability] |

| Company Sold Goods to a Customer for Cash | Company Bank Account | Sales/Revenue |

| Company Sold Goods to a Customer on Credit | Accounts Receivable [Asset] | Sales/Revenue |

| Company Pays Rent for Premises using Cash in Bank | Rent Paid [Expense] | Company Bank Acount |

| Company Receives Interest on a Fixed Deposit | Company Bank Account | Interest Received [Income] |

Debits and Credits

The entries that represent the Double Entry concept explained above, and that ultimately keeps books of account in balance, are referred to as Debits and Credits that is captured to two different accounts in the entities Chart of Accounts. The fundamental principle of bookkeeping and accounting is that every financial transaction affects at least two accounts.

Every transaction is therefore recorded in two places. For every debit entry, there must be an equal and opposite credit entry, keeping the books balanced.

A Debit Entry: What the business receives (increases assets or expenses, or decreases liabilities or equity)

A Credit Entry: What the business gives (decreases assets, or increases liabilities, equity, or income)

To illustrate, here are a few transactions for which the Debit and Credit entries are shown below:

Transaction: Company Purchased a vehicle using Cash in Bank for an amount of R 250,000

| Account Description | Debit | Credit |

|---|---|---|

| Fixed Assets - Motor Vehicles | 250,000.00 | |

| Company Bank Account | 250,000.00 | |

| Total Debits / Credits | 250,000.00 | 250,000.00 |

| Account Description | Debit | Credit |

|---|---|---|

| Fixed Assets - Motor Vehicles | 250,000.00 | |

| Company Bank Account | 250,000.00 | |

| Total Debits / Credits | 250,000.00 | 250,000.00 |

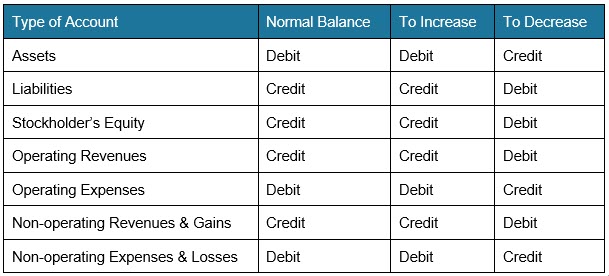

In bookkeeping, debits and credits are fundamental concepts used to record financial transactions in a company’s accounting system. They are part of the double-entry accounting system, where every transaction affects at least two accounts, ensuring the accounting equation (Assets = Liabilities + Equity) remains balanced.

Key Principles:

- Debits (Dr) and Credits (Cr) must always balance out. For every debit entry, there must be an equal and opposite credit entry.

- Debits increase:

- Assets

- Expenses

- Losses

- Credits increase:

- Liabilities

- Equity (Owner’s Equity or Shareholders’ Equity)

- Revenues

- Gains

Assets:

- Debit increases assets (e.g., buying a piece of equipment).

- Credit decreases assets (e.g., selling inventory).

Liabilities:

- Debit decreases liabilities (e.g., paying off a loan).

- Credit increases liabilities (e.g., taking out a loan).

Equity:

- Debit decreases equity (e.g., drawing money from the company).

- Credit increases equity (e.g., issuing stock or retaining earnings).

Revenue/Income:

- Debit decreases revenue (e.g., sales returns or allowances).

- Credit increases revenue (e.g., making a sale).

- Expenses:

- Debit increases expenses (e.g., paying for utilities or wages).

- Credit decreases expenses (rare, but could happen with an adjustment or refund).

Let’s say a company buys $1,000 worth of office supplies on credit:

- Debit: Office Supplies (Asset) = $1,000

- Credit: Accounts Payable (Liability) = $1,000

This reflects that the company has increased its assets (office supplies) and also incurred a liability (since it hasn’t paid cash yet).

| Account Description | Debit | Credit |

|---|---|---|

| Office Supplies | 1,000.00 | |

| Accounts Payable [Liability] | 1,000.00 | |

| Total Debits / Credits | 1,000.00 | 1,000.00 |

In accounting, there are five main types of accounts that make up the chart of accounts. These categories help organize financial transactions and are essential in the double-entry bookkeeping system. Here’s an overview of each:

Another Example:

If the company receives $500 in cash for a service rendered:

- Debit: Cash (Asset) = $500

- Credit: Service Revenue (Equity) = $500

| Account Description | Debit | Credit |

|---|---|---|

| Cash [Asset] | 500.00 | |

| Service Revenue [Revenue / Income] | 500.00 | |

| Total Debits / Credits | 500.00 | 500.00 |

Here, the company is increasing its assets (cash) and also increasing its equity (through service revenue).

In Summary:

- Debits and credits are essential to maintaining balanced books.

- Debits generally increase assets and expenses, while decrease liabilities, equity, and revenue.

- Credits generally increase liabilities, equity, and revenue, while decreasing assets and expenses.

By following these rules, accountants ensure that the company’s financial records are accurate and aligned with the accounting equation.

Here’s an overview of each:

Debits and Credits in the Accounts

Types of Accounts (Assets, Liabilities, Equity, Revenue, Expenses)

1. Assets

In accounting, there are five main types of accounts that make up the chart of accounts. These categories help organize financial transactions and are essential in the double-entry bookkeeping system. Here’s an overview of each:

Assets are resources owned by the company that are expected to bring future economic benefits.

Types of Assets

Current Assets: These are short-term assets that are expected to be converted into cash or used up within a year. Examples include:

- Cash

- Accounts Receivable (money owed by customers)

- Inventory

- Prepaid Expenses (like prepaid insurance)

- Short-term investments

Non-Current Assets (also known as long-term or fixed assets): These are assets that will provide benefits for more than one year. Examples include:

- Property, Plant, and Equipment (PP&E) (e.g., buildings, machinery)

- Intangible Assets (e.g., patents, trademarks, goodwill)

- Long-term Investments

2. Liabilities

Liabilities are obligations or debts that the company owes to outside parties and must be settled over time.

Types of Liabilities:

- Current Liabilities: These are short-term obligations that are due within one year. Examples include:

- Accounts Payable(money owed to suppliers)

- Short-term Loans or Notes Payable

- Accrued Expenses(e.g., wages or taxes owed)

- Unearned Revenue(money received from customers for goods or services not yet delivered)

- Non-Current Liabilities(long-term liabilities): These are obligations that extend beyond one year. Examples include:

- Long-term Loans or Bonds Payable

- Lease Liabilities

- Pension Liabilities

3. Equity

Equity represents the owner’s claim on the company after all liabilities have been paid off. It’s essentially the residual interest in the assets of the entity.

Types of Equity Accounts:

- Owner’s Equity (for sole proprietorships)

- Owner’s Capital (investment made by the owner)

- Owner’s Drawings (withdrawals made by the owner)

- Shareholders’ Equity(for corporations)

- Common Stock (value of shares issued to owners)

- Retained Earnings (profits kept in the business after dividends are paid)

- Additional Paid-in Capital (extra amount paid by shareholders above the par value of stock)

4. Revenue / Income

Revenue represents the earnings from the company’s main business activities.

Types of Revenue:

- Operating Revenue: Income from the company’s core business operations, such as:

- Sales Revenue (from selling goods or services)

- Service Revenue (for service-oriented businesses)

- Non-Operating Revenue: Income that comes from activities outside of the company’s core operations, such as:

- Interest Income

- Dividend Income

- Gains from Sale of Assets

5. Expenses

Expenses are the costs incurred in the process of earning revenue and running the business. They decrease equity.

Types of Expenses:

- Operating Expenses: These are day-to-day costs of running the business. Examples include:

- Cost of Goods Sold (COGS)(the direct costs associated with producing goods or services sold)

- Selling, General, and Administrative Expenses (SG&A)(e.g., salaries, rent, utilities)

- Depreciation (the allocation of the cost of tangible fixed assets over time)

- Amortization (the allocation of the cost of intangible assets over time)

- Non-Operating Expenses: These are expenses not related to the core business activities. Examples include:

- Interest Expense (on loans)

- Losses from Sale of Assets

- Tax Obligations:Bookkeeping ensures that all business transactions are recorded in a manner that complies with tax regulations. Proper records are crucial when filing taxes and preventing legal issues related to underreporting or failing to meet tax requirements.

- Audit Preparation: In case of an audit, having clear and accurate bookkeeping makes the process smoother. It allows businesses to provide necessary documentation quickly and reduces the chances of penalties.

Summary of Account Types

- Assets– Resources owned by the company (e.g., Cash, Equipment)

- Current (short-term)

- Non-Current (long-term)

- Liabilities– Debts and obligations (e.g., Accounts Payable, Loans)

- Current (short-term)

- Non-Current (long-term)

- Equity– The owner’s claim on the company (e.g., Owner’s Capital, Retained Earnings)

- Revenue– Income from operations (e.g., Sales Revenue, Service Revenue)

- Expenses– Costs incurred to generate revenue (e.g., Cost of Goods Sold, Rent)

These accounts work together in the double-entry system to ensure accurate financial reporting and proper balance between a company’s financial resources, obligations, and performance.

Recording Transactions: Journals and Ledgers

- Tracking Cash Flow: Bookkeeping helps businesses monitor their cash flow (incoming and outgoing funds). Understanding cash flow is essential to ensure there’s enough liquidity to cover operational costs, pay employees, and invest in the business.

- Preventing Overdrafts and Shortfalls: Keeping track of income and expenses allows business owners to anticipate cash shortfalls and take steps to prevent financial crises.

- Identifying Profitability: Bookkeeping allows businesses to track profitability by clearly distinguishing between revenue and expenses. This information helps in identifying which parts of the business are most profitable and which areas may need improvement.

- Long-Term Planning: Having detailed financial records supports long-term strategic planning, whether it’s for expansion, securing financing, or business succession planning.

- Tracking Expenses: Detailed records help monitor business expenses and detect any unnecessary or fraudulent spending. This makes it easier to identify areas where costs can be reduced or managed more effectively.

- Accountability: Having clear financial records provides transparency and accountability, especially in organizations with multiple stakeholders or employees.

- Trust with Stakeholders: Customers, suppliers, employees, and investors are more likely to trust a business that maintains accurate and transparent financial records. This builds confidence and strengthens business relationships.